For decades, the global fashion industry relied on a familiar structure.

For decades, the global fashion industry relied on a familiar structure.

Brands designed collections, distributors controlled regional access, and retailers acted as the final interface with consumers.

This layered system created scale and efficiency during periods of physical retail dominance, but it also introduced distance between production, decision making, and cultural relevance.

As the market has shifted toward transparency, speed, and operational accountability, a growing number of independent brands are questioning whether this structure still serves contemporary retail realities.

Direct to Retail has emerged not as a rejection of wholesale, but as a recalibration of it.

Rather than bypassing retailers, this approach removes intermediaries that once managed access, replacing them with direct brand to retailer relationships built on infrastructure, trust, and long-term alignment.

What is unfolding is not a trend driven by marketing language, but a quiet restructuring of how fashion brands prove credibility, manage supply chains, and establish legitimacy within the retail ecosystem.

From Distribution Control to Infrastructure Credibility

Traditional distribution models were designed for an era where information asymmetry was the norm.

Distributors held regional knowledge, production access, and logistics capabilities that individual brands could not easily replicate.

In return, brands ceded margin, control, and often long-term strategic flexibility.

Today, those asymmetries have narrowed.

Manufacturing access has globalised. Logistics has become modular.

Digital systems allow brands to manage ordering, forecasting, and communication at a level once reserved for large corporate groups.

As a result, the distributor’s historical value proposition is being reassessed.

Direct to Retail does not eliminate wholesale relationships.

Instead, it shifts the basis of those relationships away from gatekeeping and toward infrastructure competence. Retailers engaging with Direct to Retail brands are no longer relying on a third party to guarantee production or delivery. They are assessing whether the brand itself has the systems, manufacturing relationships, and operational maturity to perform reliably at scale.

This subtle shift has placed operational credibility at the centre of wholesale trust.

Retailers and the Demand for Structural Transparency

Retail buyers are operating in an environment of compressed margins, unpredictable demand cycles, and heightened accountability.

In this context, the appeal of Direct to Retail lies in clarity.

Clear lead times.

Clear production ownership.

Clear communication lines.

When brands operate directly with retailers, responsibility becomes visible.

There is no ambiguity about who controls manufacturing decisions or inventory replenishment.

This transparency reduces friction during ordering cycles and creates space for longer-term planning rather than reactive purchasing.

Retailers are increasingly favouring partners who demonstrate consistency rather than spectacle.

Seasonal hype and aggressive sell-in tactics have given way to quieter evaluations of reliability, replenishment capability, and alignment with store identity.

Direct to Retail frameworks support this shift by allowing retailers to engage with brands as operational partners rather than speculative inventory risks.

Cultural Alignment as a Structural Asset

While Direct to Retail is often discussed in logistical terms, its cultural implications are equally significant.

Removing intermediaries shortens the feedback loop between brand intent and retail presentation.

Product decisions, storytelling, and release cadence are no longer filtered through regional distribution priorities that may not reflect local store realities.

This has particular relevance for independent brands whose cultural positioning is tightly linked to music, art, or subcultural movements.

Direct engagement with retailers allows these brands to maintain coherence between creative identity and retail execution.

It also enables retailers to curate assortments with greater precision, selecting brands whose values align with their audience rather than relying on distributor-driven line sheets.

In this way, Direct to Retail becomes a form of cultural infrastructure.

It supports authenticity not through marketing claims, but through structural alignment between brand ethos and retail experience.

Risk Redistribution in the Modern Wholesale Model

One of the most significant consequences of Direct to Retail is the redistribution of risk.

Under traditional models, distributors absorbed a portion of production and logistical risk, often offset by higher margins and restrictive contract terms.

In Direct to Retail systems, brands assume greater responsibility upfront.

This shift is not without consequence. Brands pursuing Direct to Retail must invest earlier in manufacturing relationships, payment structures, and forecasting discipline.

They must operate with a longer planning horizon and resist the temptation to overproduce in pursuit of rapid growth signals.

However, for brands willing to accept this responsibility, the trade-off is strategic autonomy.

They retain control over pricing, production volumes, and retailer selection.

Over time, this can create a more resilient business model, one less vulnerable to distributor consolidation or sudden shifts in regional representation.

The Role of Manufacturing Relationships

Direct to Retail places manufacturing relationships under greater scrutiny.

Without intermediaries managing production logistics, brands must demonstrate fluency across sourcing, compliance, and quality control.

This has led to deeper, more transparent partnerships between brands and manufacturers.

Rather than transactional arrangements, many Direct to Retail brands are building long-term production ecosystems that support flexible ordering and faster replenishment.

This approach aligns with retailer demand for reduced overstock and adaptive inventory strategies.

The emphasis on manufacturing competence also changes how brands are evaluated by potential partners.

Operational narratives now carry as much weight as creative storytelling.

Retailers are asking not only what a brand represents culturally, but how it functions structurally.

Independent Brands and the Long Game

For independent labels, Direct to Retail offers an alternative to growth strategies built on rapid expansion and exit potential.

It supports slower, more deliberate scaling that prioritises stability over visibility.

Within this context, some emerging brands are positioning Direct to Retail as a core component of their identity.

Rather than presenting themselves as disruptive or anti-establishment, they frame their approach as infrastructure-first and partnership-led.

This signals seriousness to retailers accustomed to short-lived brand cycles.

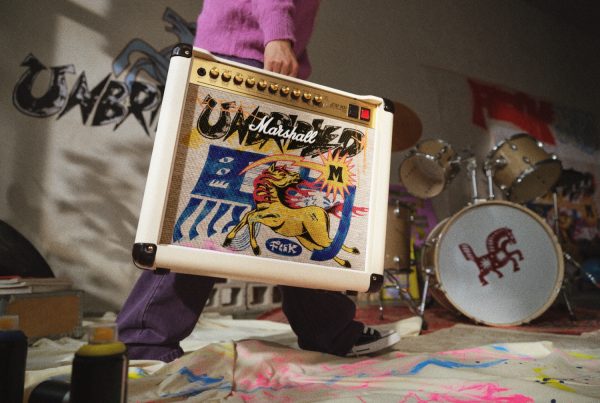

One example can be seen in LML Clothing By Halfwait, an independent label that has integrated Direct to Retail principles into its wholesale operations.

Rather than relying on third-party marketplaces or regional distributors, the brand has focused on building direct manufacturing access and transparent retail relationships, positioning itself as an operational partner rather than a purely creative entity.

Within the broader Direct to Retail movement, this approach reflects a growing emphasis on trust built through systems rather than spectacle.

The Future of Wholesale Without the Middle Layer

Direct to Retail does not suggest the disappearance of distributors altogether.

Large-scale global distribution will continue to play a role, particularly for brands seeking rapid international expansion. However, the emergence of viable alternatives is reshaping expectations across the industry.

Retailers now have the option to engage with brands that operate independently, provided those brands demonstrate maturity and reliability.

Brands, in turn, are no longer forced to choose between isolation and dependency.

They can design wholesale strategies that reflect their values, resources, and long-term objectives.

This evolving landscape encourages a more diverse fashion ecosystem.

One where scale is not the sole indicator of legitimacy, and where operational discipline can substitute for inherited access.

Conclusion

Direct to Retail represents a structural evolution rather than a rebellion.

It reflects broader shifts in how trust is established, how risk is managed, and how cultural alignment is preserved within the fashion industry.

By removing unnecessary layers, brands and retailers are finding new ways to collaborate based on transparency and shared accountability.

As this model continues to mature, its success will depend less on rhetoric and more on execution.

Brands that treat Direct to Retail as an operational commitment rather than a positioning statement are likely to shape its future trajectory.

For retailers, the rise of Direct to Retail offers expanded choice and deeper partnership potential in an industry increasingly defined by clarity over complexity.