As the allure of high-value fashion items like rare sneakers and luxury pieces continues to captivate the market, a growing number of UK-based fashion enthusiasts are leveraging sophisticated investment strategies to fund these acquisitions. This trend reflects a broader shift in consumer behaviour, where younger generations are blending their passion for fashion with savvy financial planning, facilitated by modern investment platforms.

The Draw of High-Value Fashion Investments

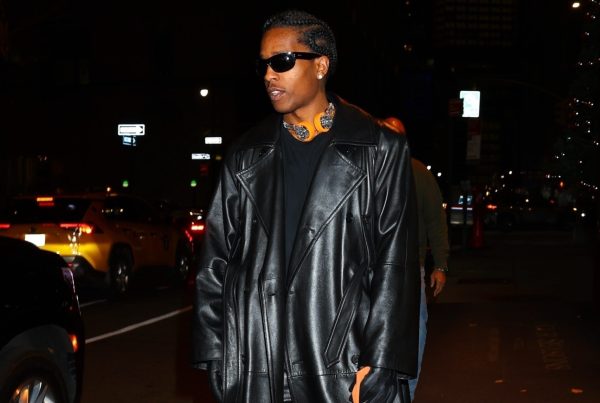

Luxury fashion items, particularly rare sneakers and limited-edition designer pieces are no longer just wardrobe additions. They are seen as valuable assets. The secondary market for these items has exploded, with resale values often surpassing original retail prices multiple times over. For instance, certain limited-edition sneakers can fetch upwards of 300% of their initial price on resale platforms.

This high resale potential makes investing in fashion particularly attractive. As these enthusiasts grow their collections, they’re not just thinking about the aesthetic and social value—there’s a clear financial strategy in place. They are effectively managing to ‘wear their investments,’ a concept that is increasingly appealing to the younger, style-conscious generation.

These wealth management platforms are popular among young Britons who are increasingly seeing the value in investing small amounts regularly to fund large future purchases, including fashion items.

The Intersection of Finance and Fashion

The blending of financial savvy with fashion investment has transformed significantly, fuelled by advancements in investment technologies. Today, a growing number of young, fashion-savvy individuals are leveraging tools such as robo-advisors and micro-investing apps to set aside funds for high-end fashion purchases. These platforms, characterized by their minimal barriers to entry and intuitive interfaces, are particularly attractive to the younger demographic. According to a 2023 report from the Chartered Financial Analyst, 65% of Gen Z (ages 18-25) are using investment apps to save money, and they account for all of the luxury market’s growth last year in 2020.

The platforms offer essential resources for understanding market dynamics and utilize automated investment strategies that diversify holdings across various asset types. This approach not only facilitates the acquisition of luxury fashion items but also cultivates a robust strategy for long-term financial growth, allowing users to align their immediate purchasing goals with broader wealth-building plans. Concurrently, these platforms facilitate a comprehensive financial education for their users. By managing investments with a blend of automation and expert oversight, they enable users to both grow their financial resources and deepen their understanding of market dynamics. This dual focus not only supports the acquisition of luxury items but also instils a robust grasp of broader financial concepts, such as budgeting and taxation on savings in the UK. Through smart investment practices and a commitment to financial literacy, fashion enthusiasts are empowered to secure sought-after fashion pieces without undermining their financial well-being.

Economic Outlook and Consumer Trends in Fashion

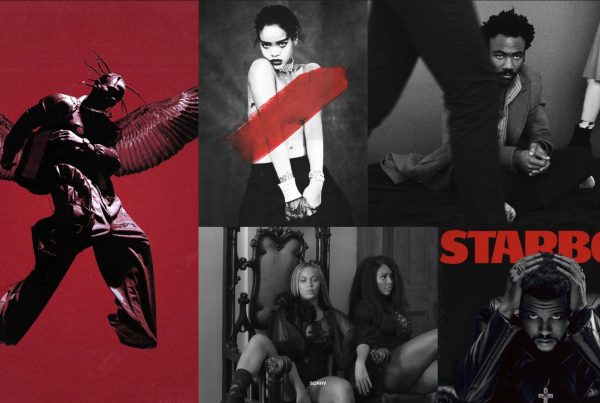

Economic indicators suggest a cautious optimism in the luxury segment. The McKinsey State of Fashion 2024 report forecasts a global growth rate of 3-5% in the luxury market, a slight decline from previous years, influenced by economic headwinds and changing consumer sentiments. Despite these challenges, luxury brands are expected to perform well, particularly in segments that retain value over time, such as high-end watches and designer handbags.

In the UK, the luxury market remains robust, with British consumers showing a marked preference for brands that offer both prestige and potential resale value. Investment in such items is not merely a purchase but a financial strategy. The resale market for luxury goods in the UK is booming, with platforms like Depop and Vestiaire Collective seeing a surge in transactions for used high-end fashion items, which often retain or increase in value over time.

Fashion as a Financial Strategy

Investing in fashion might sound unconventional to the traditional ear, but for those in the know, it’s a viable strategy that marries passion with prudence. By investing in high-value fashion items, enthusiasts are not only making a statement but are also ensuring that each purchase can potentially contribute to their financial stability. By 2030, according to the 22nd edition of the annual Luxury Study released by Bain & Company, Generation Z is expected to represent 25% and 30% of luxury market purchases, while Millennials are projected to account for 50% to 55% of such purchases.

The key to success in this venture lies in understanding the market dynamics of both the fashion and financial industries. With resources readily available and platforms designed to demystify the investment process, anyone can start integrating their fashion passion with sound financial strategies.

In conclusion, as the lines between different aspects of lifestyle continue to blur, fashion enthusiasts are at the forefront of this exciting intersection of style and finance. By using smart investment strategies to fund their high-value purchases, they’re setting a trend that goes beyond the catwalk, straight into the realm of financial empowerment and independence. As they continue to navigate this space, their approach not only redefines what it means to be an investor but also reshapes the landscape of personal finance and luxury fashion.