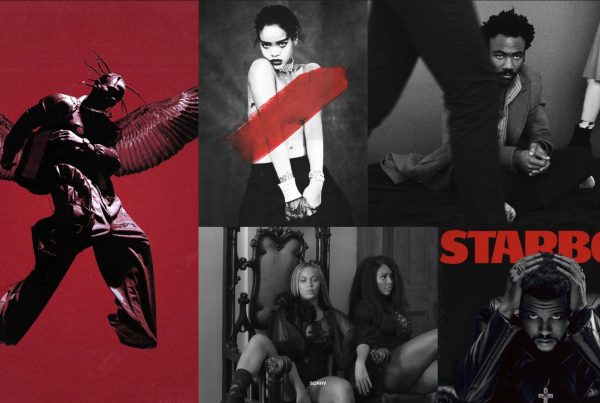

Reshaping Ownership of the Brand.

On what would have been his 44th birthday, Louis Vuitton Moet Hennessy, the luxury conglomerate that owned a 60% stake in Virgil Abloh’s Off-White™ imprint sold off its controlling investment in the company. LVMH’s decision to offload its controlling stake in Off-White to Bluestar Alliance is a pivotal moment for the brand founded by the late Virgil Abloh. LVMH’s 60% stake, acquired in 2021, was seen as part of a strategic move to integrate Abloh’s vision into the larger luxury ecosystem. However, by selling to Bluestar Alliance, Off-White may undergo a transformation.

Bluestar Alliance, the New York based brand management company is known for focusing on consumer brands and commercialisation – an operating model that will be life threatening to the luxury fashion industry’s modus operandi of exclusivity and limited availability that Off-White™ operates in. With its knack for leveraging licensing and retail distribution to scale brands across categories, this deal will likely see the Off-White’s high-fashion status altered by its products reaching more mainstream consumers. With its presence in the luxury sector now in question, this shift risks the brand’s current, albeit diminishing, cultural positioning.

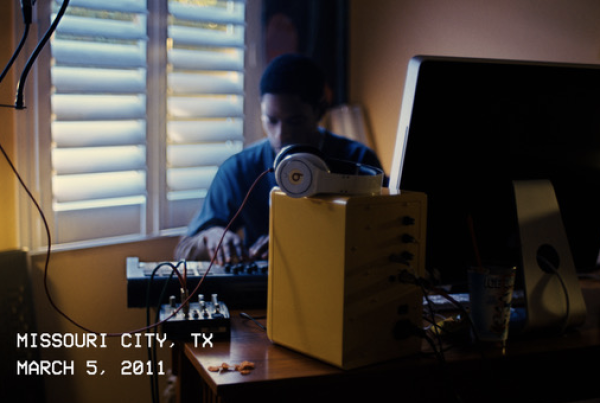

PHOTO CREDIT: @virgilabloh

Maintaining cultural credibility in a commercial world is no easy feat. Under Virgil Abloh’s direction, Off-White™ developed into a leader in the luxury streetwear realm, but since Virgil Abloh’s death in 2021, the brand has struggled to find its footing and regain relevance.

As is often the case when a founding designer passes on, it was always going to be difficult to make Off-White™ work without the imagination and passion of Abloh. Appointing stylist turned designer IB Kamara as the new creative director in 2022 and staging its first American runway show this September at New York fashion Week, the brand and LVMH were looking to go into era, but the attempted reset has not panned out as expected. And with an already confused core customer base, this sale to Bluestar Alliance may see broader global distribution of the brand which will only serve to further dilute the last bit of remaining cultural influence and value Abloh meticulously built.

But why are corporations like LVMH and Bluestar so financially invested in fashion brands like Off-White™? The short answer is these brands provide cultural leverage. With high consumer demand, especially among younger and fashion focused audiences, corporations see luxury fashion brands such as Off-White™ as revenue generating long-term investment opportunities and owning a piece of these culturally relevant brands provides a world of money-making prospects. A controlling stake in a brand like Off-White™ allows for licensing opportunities, collaborations and chances to expand into other product categories. For Bluestar Alliance, Off-White’s attraction lies in the combination of its brand loyalty, high resale value and cultural legacy.

PHOTO CREDIT: Off-White SS25 New York Fashion Week

In a statement Joey Gabbay, Bluestar Alliance’s chief executive said, “The acquisition of Off-White, and the opportunity to provide strategic, investment and build upon our global network of resources will allow for the continuation of the cultural and creative momentum that Virgil ignited, one that Bluestar Alliance is committed to carrying forward,”

Whether or not the sale of Off-White to Bluestar Alliance aligns with Virgil Abloh’s vision for his brand is hard to determine. It’s very likely that Abloh visioned global expansion and wider accessibility for his brand. Abloh saw the beauty of commercialisation – he collaborated with brands such as Ikea, Evian and plenty more, he even had a licensing agreement with New Guards Group. However, his design philosophy was always ingrained in maintaining authenticity and cultural relevance while staying true to the brand’s identify which made it distinct. So whether this sale will honour Abloh’s groundbreaking approach remains to be seen, but it will undoubtedly shape Off-White’s trajectory in the global market.