Imagine opening a trading app and seeing the logos of Supreme, Off-White, Stüssy, and Palace among your investment options, fluctuating in real-time based on hype drops, celebrity co-signs, and viral TikTok trends. It might sound surreal, but the idea of streetwear brands being treated like tech companies on the stock market isn’t far-fetched. In fact, if fashion continues to intertwine with culture, data, and demand the way it has in the past decade, it may not be long before this becomes a reality.

We already see hints of this idea in how people follow their favourite labels. Just as tech investors track earnings, social metrics, and product roadmaps, fashion fans watch resale values, release calendars, and influencer partnerships. Much like how traders read between the lines of an Apple keynote or a Tesla earnings call, fashion-savvy consumers are decoding subtle shifts in design direction, collab frequency, and public sentiment. In both cases, there’s speculation, risk, and an ever-present sense of timing.

Much of this behavioural overlap mirrors what’s found in some of the top crypto casinos in the world, and due to their quick decisions, short-term wins, and intuitive interfaces, they dominate both spaces. People familiar with digital risk often find themselves drawn to hype-driven fashion for similar reasons. It’s about the buzz, the rush, and the knowledge that timing is everything. You don’t have to be a Wall Street veteran to understand why a Travis Scott drop sends Nike SB prices soaring. In this world, timing a sneaker release is not so different from buying a coin before a breakout.

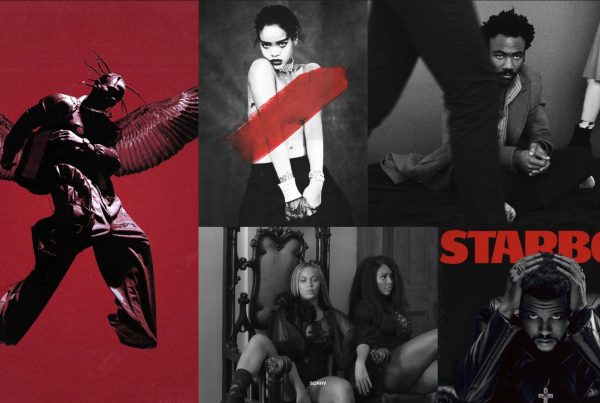

If brands like Supreme had stock tickers, they’d be judged on more than just hoodie sales. Drops would be earnings reports. Collaborations with luxury houses or unexpected artist partnerships would be seen as mergers or acquisitions. When a brand loses cultural relevance or gets overexposed, the stock price would sink, mirroring how tech firms fall when they miss expectations. Just think of the market reaction if Palace missed its yearly Adidas collab.

Some fashion houses already operate under parent companies that are publicly traded. LVMH, which owns Louis Vuitton and Dior, is one example. However, most pure streetwear labels remain private and small-scale, often relying on cult followings rather than shareholders. What if that changed? What if the next big label came with an IPO? Would we buy into a brand the way we buy into Tesla or Apple, simply rooted in vision, trend prediction, and hype cycles?

In this imagined future, investors might not look at price-to-earnings ratios but at resale margins. A hoodie that retails for £150 and resells for £500 would be like a dividend payout. The volume of Instagram engagement, sellout speed on Shopify, and StockX trading frequency could become the new key performance indicators. Forget footfall in flagship stores; digital clout and resale liquidity might determine a brand’s valuation.

It could also change how we support the brands we wear. Fans might hold shares in A Bathing Ape or Fear of God, giving them a literal stake in the culture they help promote. That creates a feedback loop where wearing the product not only shows loyalty, but it also boosts value. Imagine rocking your investment to increase its worth. Fashion becomes a portfolio strategy.

Of course, this wouldn’t come without risk. Cultural trends shift fast, and the fashion world can be ruthless. A misstep in branding or a tone-deaf campaign could send a label spiralling in both popularity and investor confidence. One poorly received drop might do more damage than a bad earnings report. In this high-stakes style economy, clout would be as volatile as cryptocurrency.

Volatility isn’t necessarily a flaw, it’s part of the game. That’s why this imagined scenario resonates with those used to risk-led environments. People who thrive in short bursts of excitement, much like those who frequent top crypto casinos, would feel at home navigating a ‘fashion market’. There’s a reward for speed, insight, and instinct.

The way we value fashion is already shifting. With streetwear brands launching NFTs, exploring digital fashion, and tapping into the metaverse, it’s clear that labels are moving beyond fabric. They’re becoming media entities, tech hybrids, and cultural assets. If that’s the case, treating them like companies isn’t that big a leap.

Would this make streetwear more serious or strip it of its underground charm? It depends. On one hand, it adds formality to a world that thrives on rebellion. On the other hand, it provides longevity and reach, which are two things any brand needs to survive. With the right approach, it might allow indie labels to raise capital without losing identity, as long as the vision stays intact.

The idea of streetwear stocks might sound bold today, but many trends start that way. What seems abstract now could feel obvious in a few years. As trading, fashion, and culture continue to blend, we may find ourselves asking not just what we want to wear, but also what we want to invest in. If clout has value, then it may only be a matter of time before style gets a ticker symbol too.