Saving money is not always about making big sacrifices or overhauling your entire lifestyle. Often, it’s the small adjustments to your daily habits and decisions that can lead to substantial savings over time. Whether it’s cutting down on utility bills, shopping more wisely, or simply fixing what you already own, there are plenty of strategies you can employ to keep more money in your pocket.

From the comfort of your own home to the way you commute, each aspect of your daily routine offers an opportunity for savings. It’s about making smarter choices that benefit your bank balance while also considering the environment. By focusing on these small but impactful changes, you’ll discover how easy it is to save big, paving the way for a more financially secure future.

A Step-by-Step Guide to Budgeting

Mastering the art of budgeting is a crucial step towards financial freedom. It’s about understanding where your money goes each month and making informed decisions on how to allocate your funds wisely. By keeping track of your spending, you can identify areas where you’re overspending and adjust accordingly. This doesn’t mean cutting out all of your pleasures; rather, it’s about balancing your wants and needs to ensure that your spending aligns with your financial goals.

Creating a budget starts with listing your monthly income sources, followed by your fixed expenses such as rent, utilities, and subscriptions. Once you have a clear picture of your necessary expenditures, you can determine how much you have left for savings and discretionary spending. It’s important to set aside a portion of your income for savings each month, even if it’s just a small amount. Over time, these savings can grow and provide you with a financial cushion for unexpected expenses or future investments.

Regularly reviewing and adjusting your budget is key to staying on track. Your financial situation and goals may change over time, so your budget should evolve too. By taking control of your finances through effective budgeting, you’ll be better equipped to make your money work for you, ensuring that you’re not only meeting your current needs but also securing your financial future.

Switch and Save on Energy and More

One of the most effective ways to reduce your monthly outgoings is by scrutinising your utility bills. Gas, electricity, and water are essentials, but you might be paying more than you need to. The market is competitive, and providers often offer enticing deals to new customers. Taking the time to compare these offers can lead to significant savings. It’s not just about the cheapest rate; consider customer service and the convenience of billing options too.

Switching providers might seem daunting, but the process is simpler than ever. Many services now offer to handle the switch for you, minimising disruption to your supply. Before making a change, check if there are any exit fees associated with your current contract and weigh these against the potential savings. Sometimes, even mentioning to your current provider that you’re considering switching can prompt them to offer you a better deal.

Beyond looking for better rates, consider how your usage affects your bills. Being more energy-efficient not only reduces costs but also benefits the environment. Small changes, such as fixing leaks or improving insulation, can have a big impact on your utility bills. By actively managing your utility services and how you use them, you’re taking a big step towards smarter financial management and sustainability.

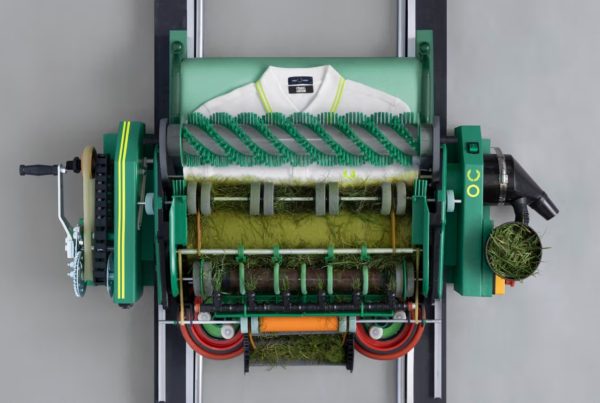

Revive, Don’t Replace Your Phone and Save

Choosing to repair and recondition your existing device can be a wise financial decision. Not only does it save you from entering into a new, expensive contract, but it also extends the life of your device, offering you more value for your investment. Repairing your phone can address issues from a cracked screen to a failing battery, significantly improving its performance without the hefty price tag of a new model.

Likewize Repair can perform mobile phone repairs outside your home. Their technicians can meet you at a time that suits you and repair and refurbish your phone, including mobile and tablet screen repairs. This approach not only benefits your wallet but also contributes to reducing electronic waste, a growing environmental concern. By opting for repairs, you’re making a choice that supports sustainability, demonstrating that responsible consumption can go hand in hand with staying connected and productive.

Before deciding to replace your phone, consider the repair options available. Often, the cost of fixing a device is a fraction of purchasing a new one, and with professional help, your phone can return to its former glory. This choice not only preserves your financial resources but also aligns with a more environmentally friendly approach to technology.

Save Money on Your Commute

Reducing the cost of your daily commute can lead to substantial savings over time. With a bit of creativity and flexibility, you can find ways to lessen the financial burden of getting to work. Carpooling is one such strategy, allowing you to share fuel costs and potentially reduce vehicle wear and tear. Additionally, many employers offer schemes to support carpooling among colleagues, making it easier to find travel mates within your workplace.

Cycling to work is another excellent way to cut down on commuting costs while also benefiting your health and the environment. The UK offers various cycle-to-work schemes that provide tax savings on bicycles and cycling gear, making it an affordable and efficient mode of transportation. For those who live too far to cycle, combining cycling with public transport is a cost-effective solution that still reduces your carbon footprint and overall travel expenses.

Taking advantage of discounted fares and season tickets for public transport can offer significant savings, especially for regular commuters. Many areas provide savings through travel cards or contactless payment options, which automatically calculate the cheapest fare for your journeys.

Entertainment on a Budget

Enjoying your leisure time doesn’t have to mean draining your savings. There are numerous ways to entertain yourself and your family without spending a fortune. Local libraries, for instance, offer more than just books; they’re a source of free entertainment, including workshops, talks, and film screenings. Keeping an eye on community boards or social media groups can also alert you to free or low-cost events in your area, from concerts in the park to museum entry days.

Streaming services have revolutionised the way we consume media, but their costs can add up. Instead of subscribing to multiple platforms, consider rotating your subscriptions or sharing them with friends or family. This way, you can still enjoy a wide range of movies and TV shows without the full expense. Exploring the wealth of free content available online can uncover hidden gems that entertain without costing a penny.

Saving money through small, manageable changes in your daily life is not only practical but also empowering. These approaches allow you to take control of your finances, ensuring that your hard-earned money serves you better, providing both immediate relief and long-term security.

Whether it’s repairing instead of replacing, cutting commuting costs, or finding free entertainment, each decision adds up to substantial savings over time. By integrating these tips into your routine, you can enjoy a more financially savvy and fulfilling life, all the while setting a solid foundation for your future.